This excel spreadsheet was made by one ‘family farm business’ of sorts, with another type of family in mind – take a read and get ahead

Running a family farm ought always to be profitable.

A little known fact…

This website, Smallholdings For Sale, is run by a family business. Our expertise is digital marketing and the internet is our farm.

Whilst our labour is desk-based as opposed to field-based – we still share many common challenges of our agricultural counterparts.

One such challenge when running a family ‘farm business’ is separating out your household finances from business monies – on paper.

Segmentation, ring-fencing and swim lanes are all common managerial terms for seeing the wood for the trees…

But what does this mean in practice to you and me?

Perhaps, not a lot?

“Oh, for someone who would just make complicated things simple!”

…especially when it comes to farms and their finances.

Enter Smallholdings For Sale!

We’ve heard the cry and responded to the need.

We have taken the initiative & committed ourselves to bridging the gap between smallholding owner & the acquisition of expert business tuition, minus the exorbitant fees.

Our online digital business courses, built using industry standard protocol and methodologies, are made friendly enough for the most basic users to learn confidently.

Our goal is to simplify, without losing any value.

No dilution, just apportioned and flavoured to appetite and palate.

Templates, calculators and frameworks all do the hard work of a professionally trained finance professional.

Meanwhile, you simply punch in your numbers and sit back to watch the results appear.

So, what have we prepared to help with family farm finances – for documenting them distinctly, in order to see what’s really going on?

We’ve built an all-in-one beginner’s desktop tool.

= Family farm profit/loss (income statement) excel spreadsheet.

What difference does it make to use this spreadsheet vs. the thousands of profit/loss excel templates already out there?

Clarity…

A clearer understanding of both your household finances, alongside, your farm business income/expenses.

All within one simple statement.

See what belongs where and then piece by piece build up the picture in order to arrive at a neat and tidy destination of overall earnings.

Sound good to you?

Why not take a look for yourself?

Welcome to the family farm profit/loss excel spreadsheet…

17-part introduction

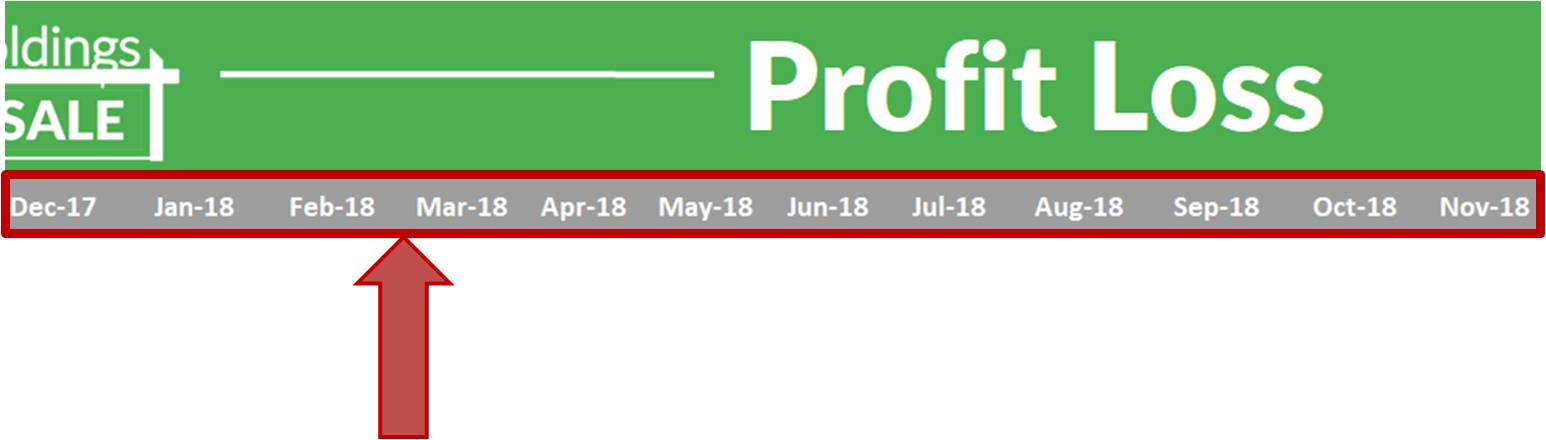

#1 Date range

12 month duration, which is entirely editable. Customise this range to suit your own chosen reporting period.

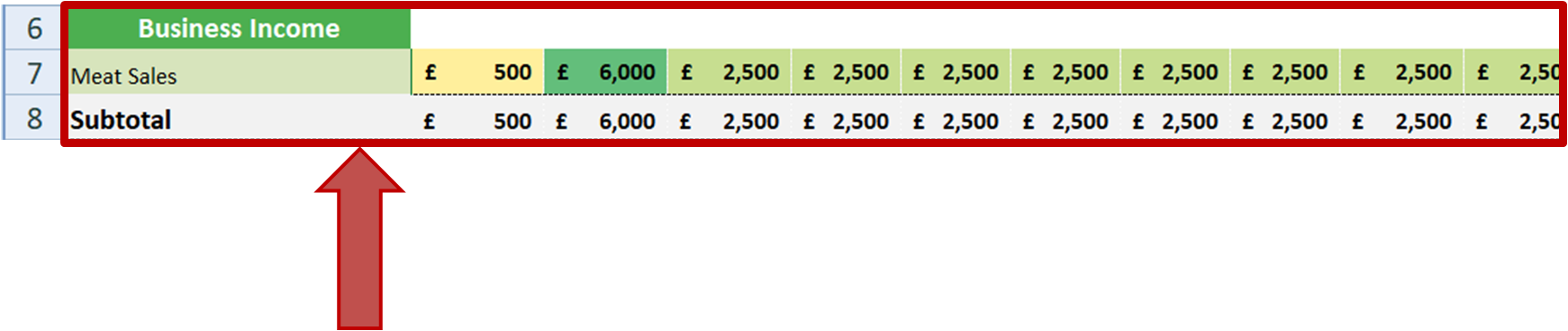

#2 Business income

This is where income from your various agricultural related businesses is declared.

Separate out each business project and name it in the first column.

Regardless of the number of income streams, all you need do to expand the entry capacity is to ‘insert’ a new row for each business.

The figures in the grid are formatted to mimic a heat map – highlighting by colour gradient the differences in amounts.

Whilst this does not suffice a detailed farm income statement it does allow you to use a round figure to line-up against household budgetary matters further on.

The total is self-calculating.

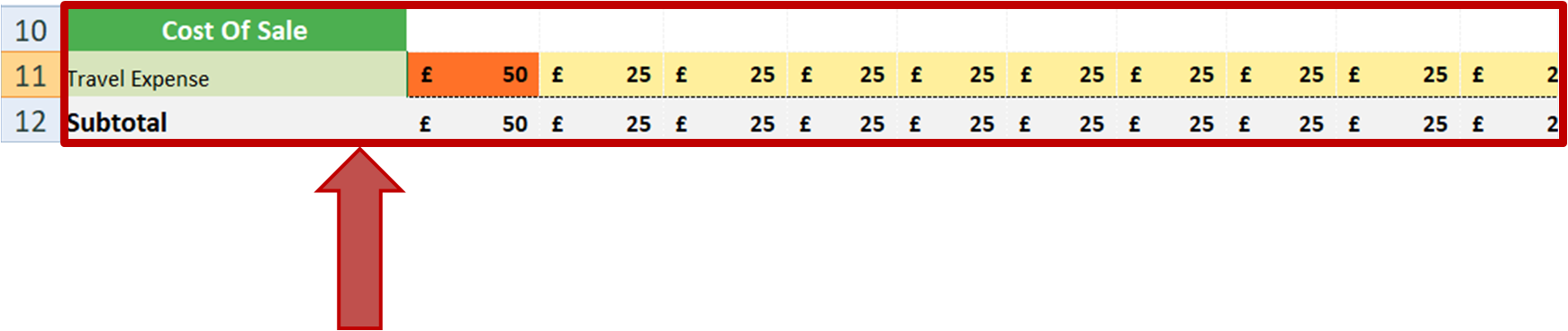

#3 Cost of Sale

Costs directly related to performing the act of product or service provision are inserted here.

You want to group the costs by category, name them and allocate the summary costs.

The grey subtotal strip is auto-calculated.

#4 Gross profit

Quite simply business income minus cost of sales.

Directly lined up, one against another.

The result of this simple subtraction is self-calculated.

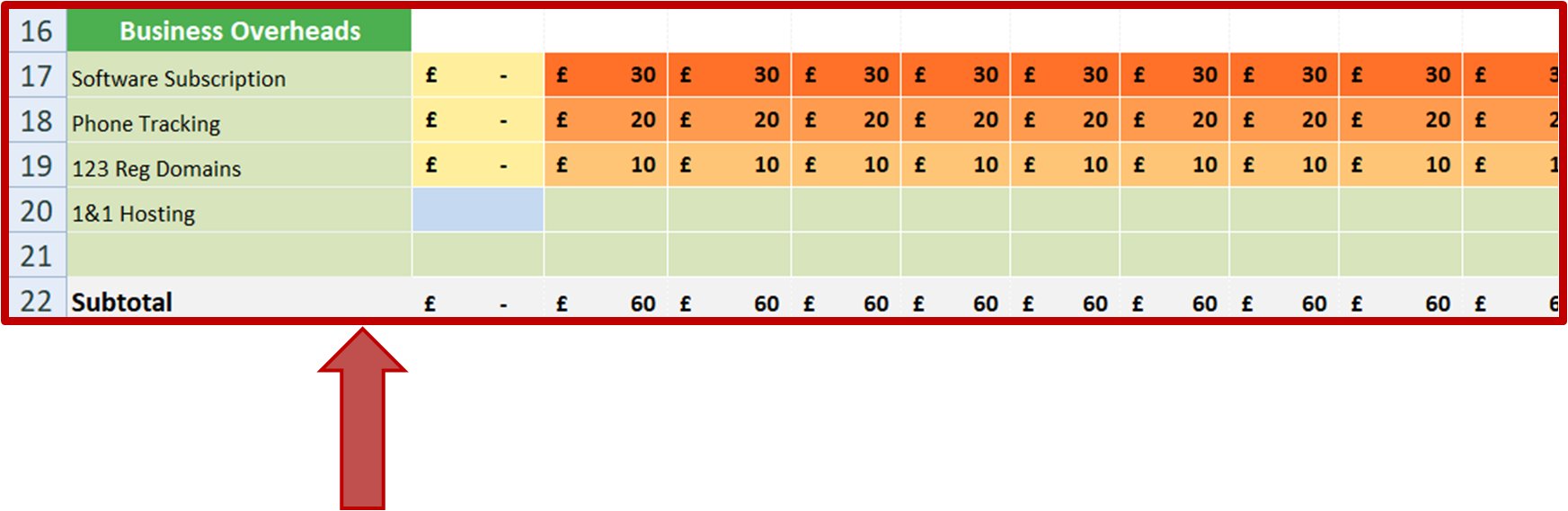

#5 Business overheads

Routine business costs, not directly influenced by sales activity go here.

There are the continual, run of the mill costs that come in cyclically.

You can’t avoid them and they typically stay the same.

The grey sub-total row is self-calculating.

#6 Operational profit

Take away from your gross profit the cost of overheads and you are left with operational profit.

This tells you how much money your business has retained after paying out all it needs to sustain operation.

Again, auto-calculating totals apply.

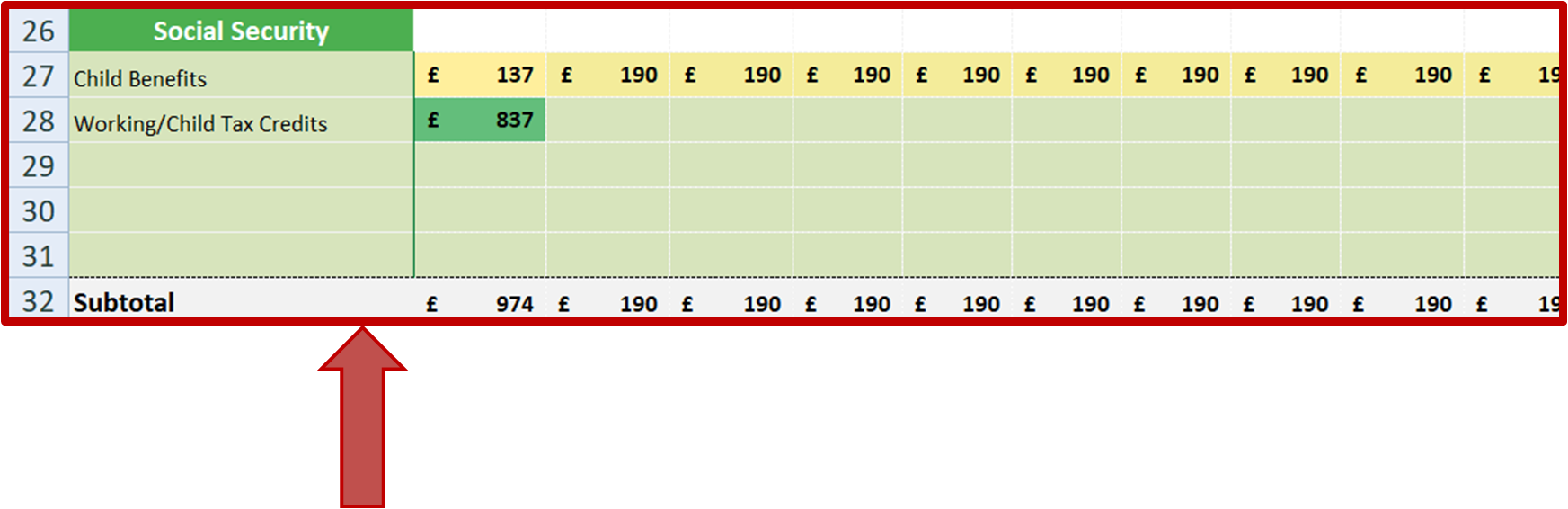

#7 Social security

This is the first non-farming related item within this profit/loss statement.

What is social security?

If your household is in receipt of social security income, i.e. personal entitlements and government awards for supplementary income, place it here.

The grey strip is auto-calculated.

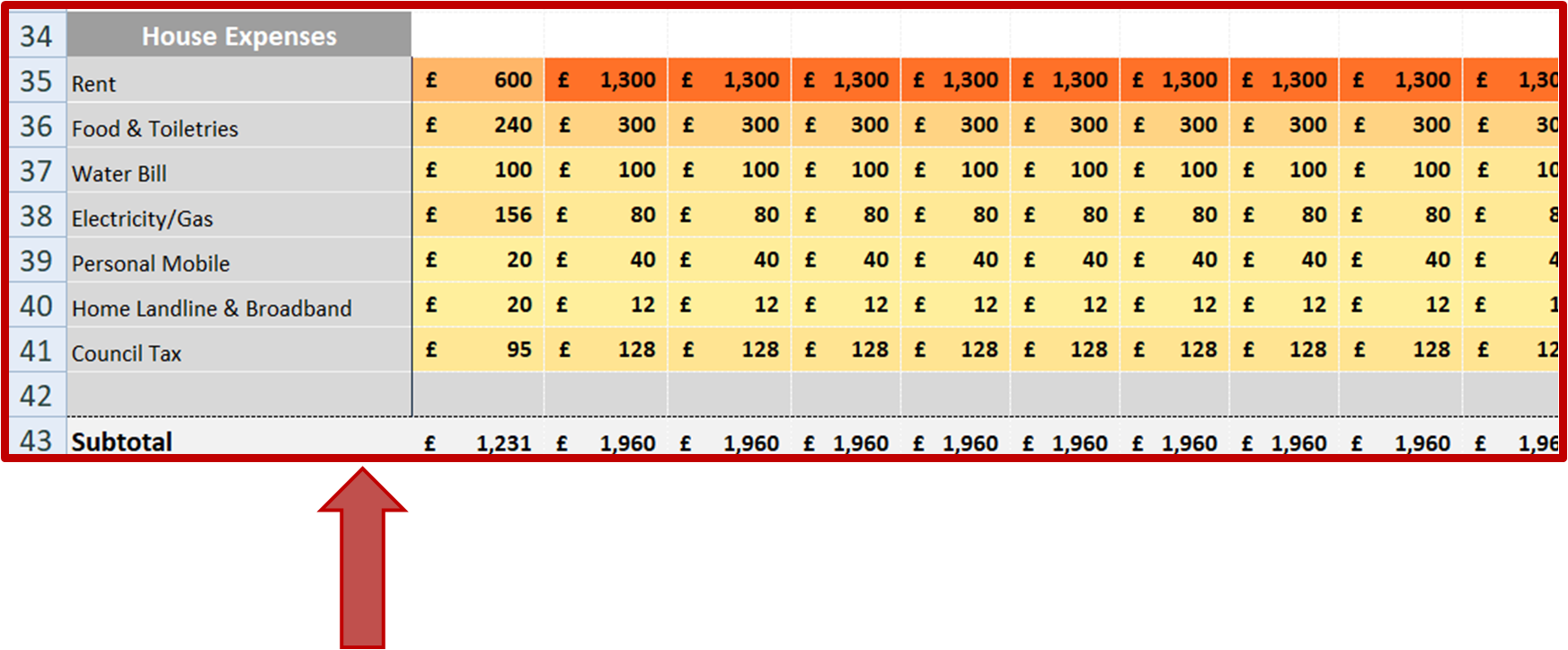

#8 Household expenses

Your routine household expenses go here.

Everything that goes out of your house as an expense, non-business related, should be entered in here.

The sub-totals are auto calculated.

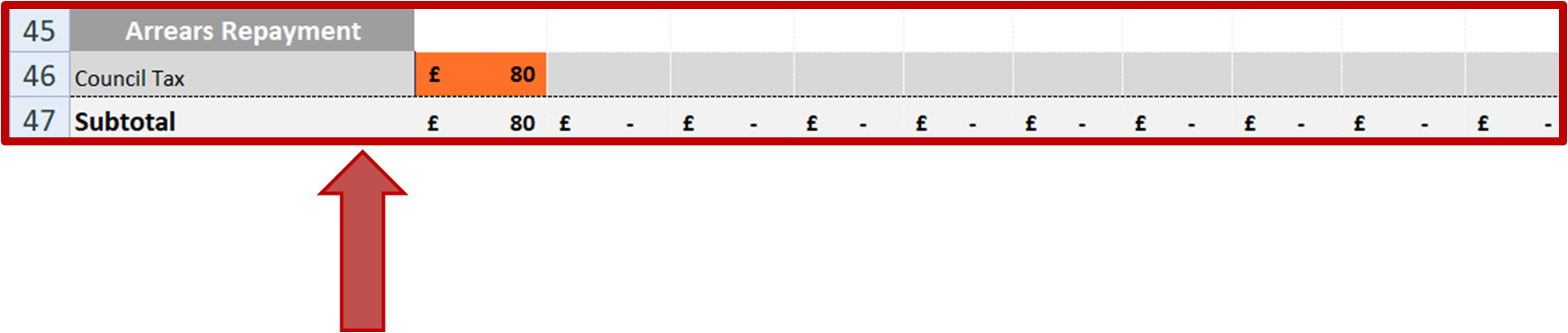

#9 Arrears

Are you behind in any personal financial obligation (…again, non-business related)?

Do you have a catch-up plan to repay the arrears piecemeal?

If so, place your figures for repayment in here.

The grey row at the bottom declaring sub-totals is auto-calculating.

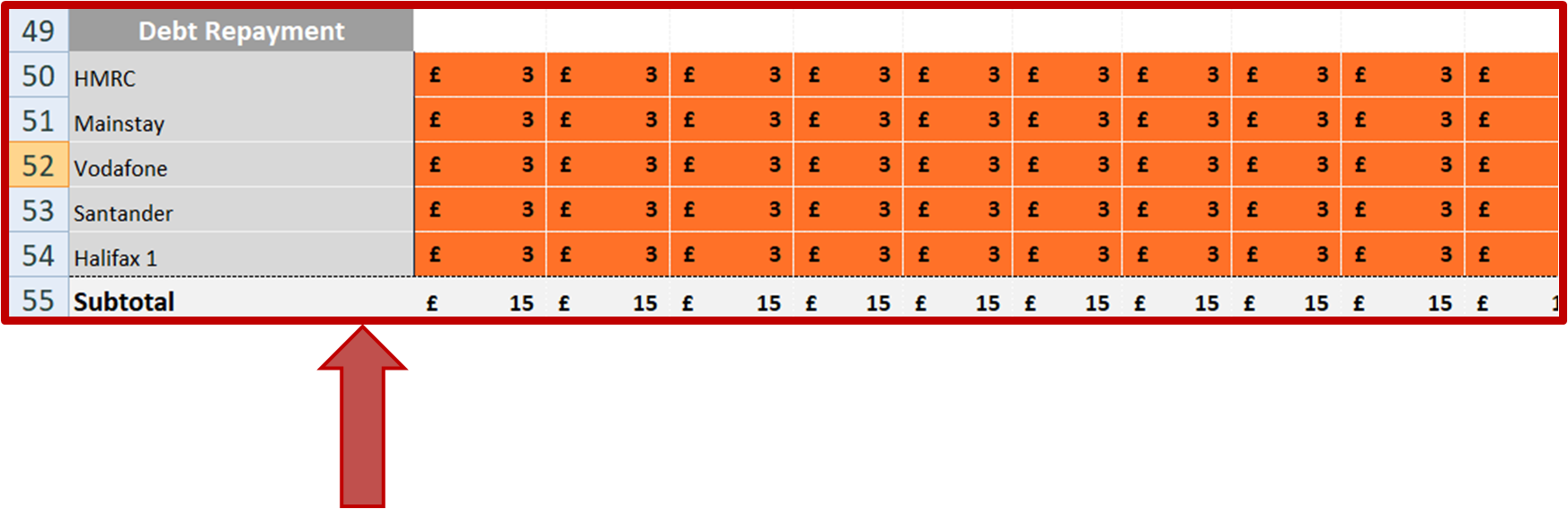

#10 Debt repayment

Do you have personal/household debts to pay back?

Do you have a payment plan with each creditor?

Declare your agreed payments here and account for your debt repayment.

Auto-calculating subtotals.

#11 Fixed family profit/loss

What is fixed family profit when it’s at home?!

Great question.

Well, you’ll never pass any formal accounting exams quoting this phrase, that’s for sure…

call it a ‘Smallholdings For Sale-ism‘…

a self-coined definition.

What is the formula for this item?

- Fixed family profit = Social Security Income – Household Expenses – Arrears Repayment – Debt Repayment

How does it help you to know such a figure? What is it telling us?

It gives us an appreciation for what would be left over after our fixed social security income has been absorbed by household expenses, arrears & debt repayment.

In other words, it answers the question…

what does our farm business really have to make in order to keep our family afloat financially, as a bear minimum?

A number worth knowing.

The totals are auto-calculated.

#12 Household profit

How much money does your family retain after accounting for the major factors of…

- whole farm operating profit

- social security income

- household expenses

- arrears repayment

- debt repayment

This tells you how much profit your family makes following your core labour output.

A critical figure for financial survival.

Auto-calculating too.

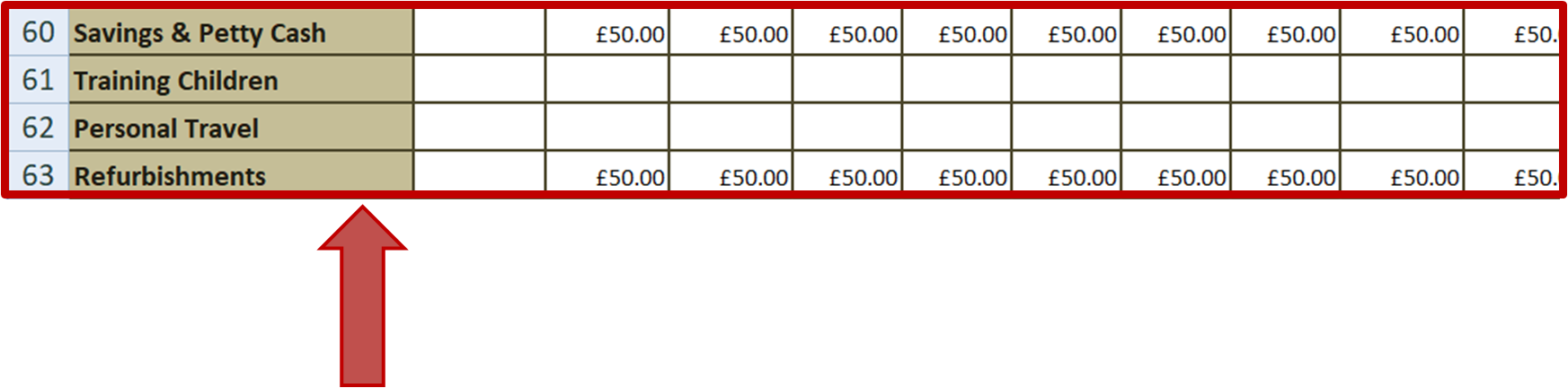

#13 Mini-house budgets

Want to put some money aside for one or other household project and don’t know where to put it?

Look no further.

This is exactly why we developed this little table here.

A miscellaneous category.

Feel free to use it.

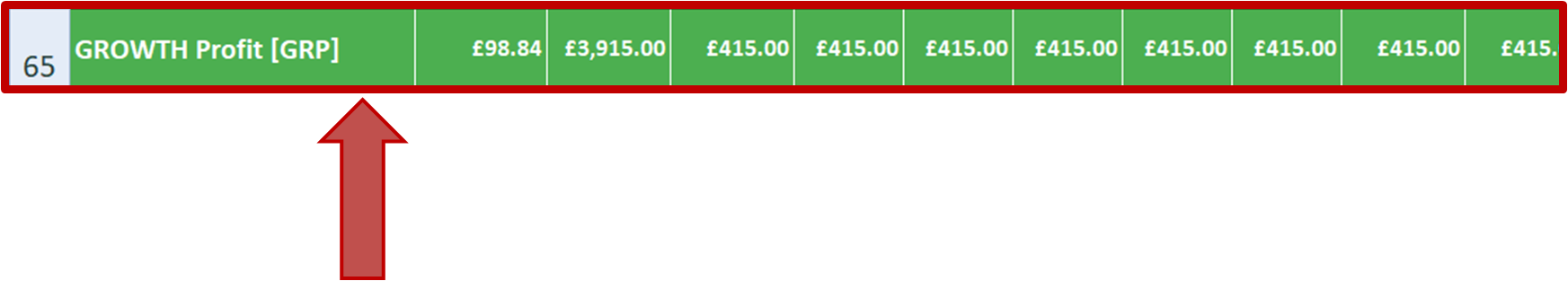

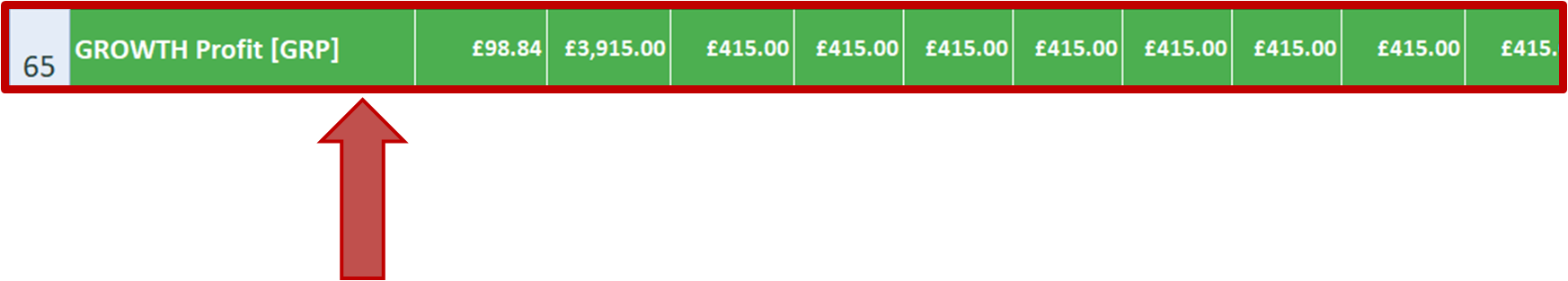

#14 Growth profit

Subtracting your mini-house budgets from household profit – gives you a figure of what’s left over after everything household-wise is taken into account.

The sum here is auto-calculating.

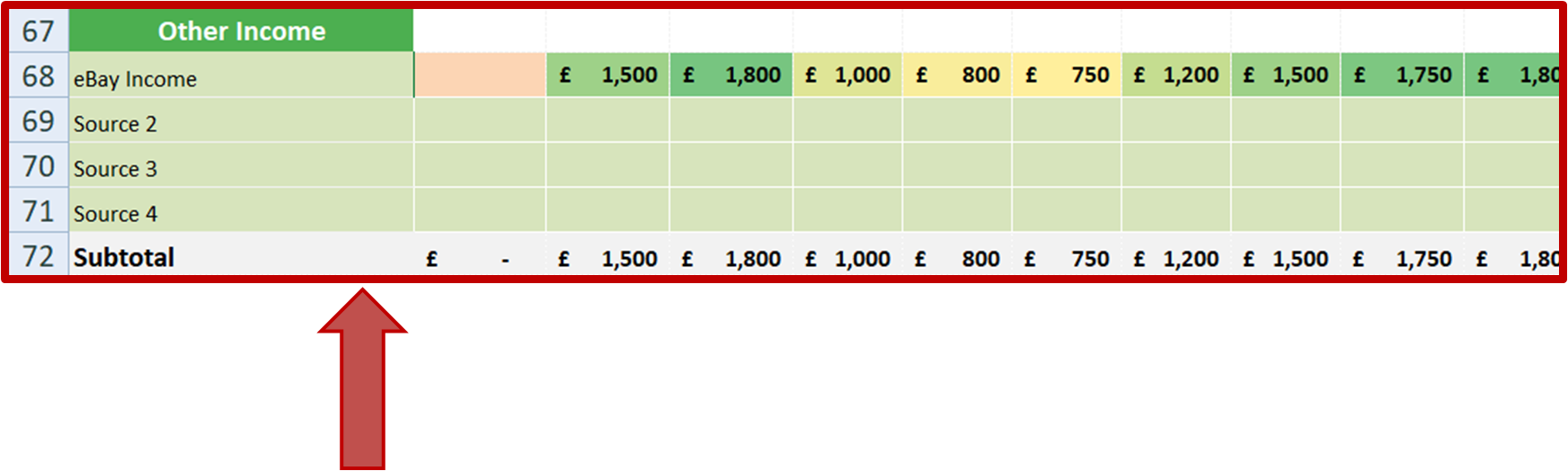

#15 Other income

Do you or any members of your household make any other side income?

Part-time employment maybe?

An eBay shop?

An affiliate marketing website?

Sell knitwear in the winter?

Put your side side income here.

Subtotals in the grey row at the bottom are auto-calculated.

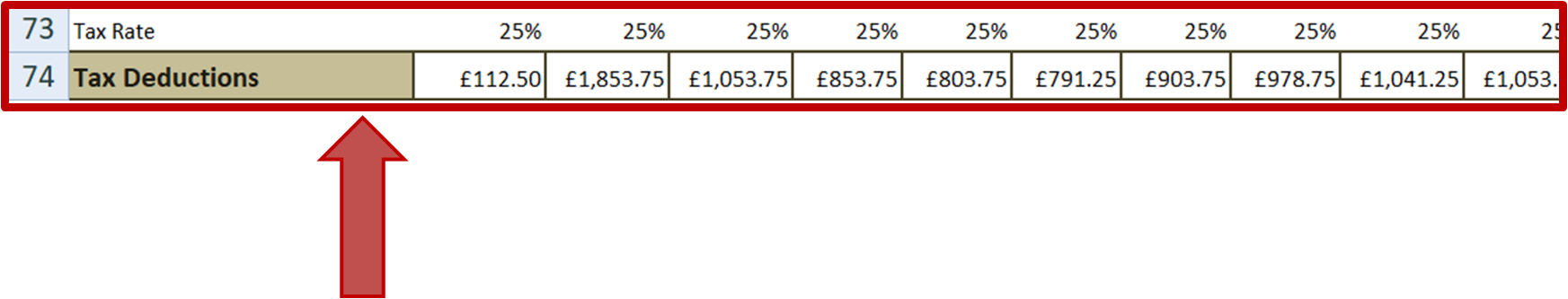

#16 Income tax

Perhaps a bit oversimplified for and unsuitable for all tax circumstances.

But a broad-brushstroke method of accounting for the tax man.

Simply apply the appropriate tax percentage and the rest is done for you and an absolute figure given for how much income tax is owned.

Just an estimate more than anything.

Insert the percentage and the deductions are auto-calculated.

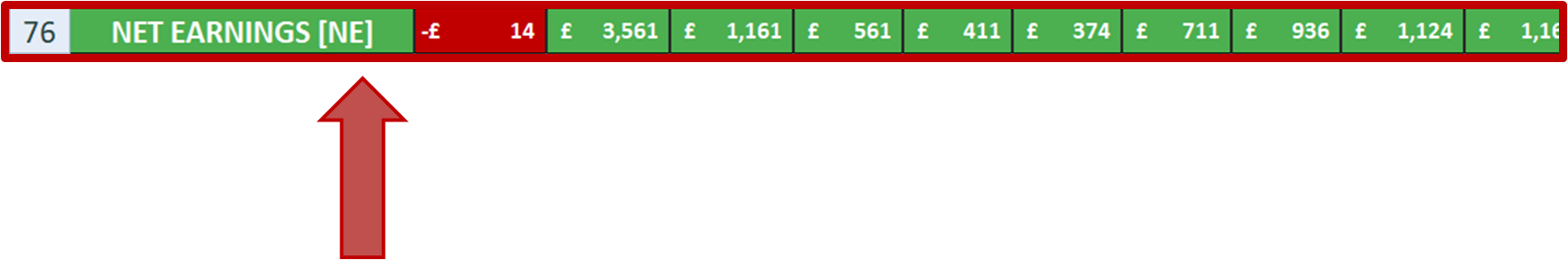

#17 Net earnings

At the end of all of this – not forgetting income taxes, of course – you have what’s left over which is know as ‘net earnings‘ and is commonly used for:

- re-investment in business

- savings

- moving

- funding another start-up plan

etc…

The round-up…

Whilst the above excel framework might not be to the individual tastes of everyone, we hope it offers a sensible method for documenting your family farm profit.

Limitations

This spreadsheet has the following limitations:

- doesn’t incorporate income statement adjustments, like depreciation

- income tax calculation is simplified – without threshold inclusion

Any comments?

Write below.