Need help writing your farm income statement? This detailed guide should be all you need to know

Your farm income statement is a head-to-head challenge between your income and outgoings.

It’s otherwise known as a income and expenses statement.

What does a farm income statement consist of?

It is pertaining to a given period…usually a month, quarter, year or custom ‘time frame’.

In it’s simplest form, it comprises a list of income figures, offset against a list of expenses and a final profit/loss total.

[A] Where the income total exceeds the expenses total…

…your farm business is showing a profit.

[B] Where the sum of income received is lower than the total of expenses…

…your statement declares a loss.

Does it get any more difficult than that?

It certainly gets more detailed, but we’ll leave the assessment of difficulty up to you.

We hope our way around it encourages, rather than discourages.

Typical Ways Of Presenting Profit Within Your Farm Business…

Your farm business may well be comprised of multiple enterprises (divisions), all under one roof.

If this is the case, you may be considering that it may be an advantage for you to report on the profitability of each division.

Seeing the profitability of each enterprise distinctly will assist you in making optimal investment decisions.

Do you have multiple revenue streams? Want to know how each is performing? Calculate gross profit

Treat each revenue stream as a separate enterprise.

Each gross profit statement therefore is a standalone report of profitability for the corresponding enterprise i.e. dairy, poultry, campsite…etc.

- Enterprise output – sales revenue figure produced by the productivity of this enterprise

- Variable costs – costs directly related to or accumulated by the performing of this operation

- Gross margin – result of subtracting the variable costs from the related output

- Totals – subtotals of output, costs and margins, as well as, grand totals

- Per head – as proportional to the number of livestock units, known as heads

- Per hectare – as proportional to the number of hectares of land involved

- Performance details – indicators of enterprise performance

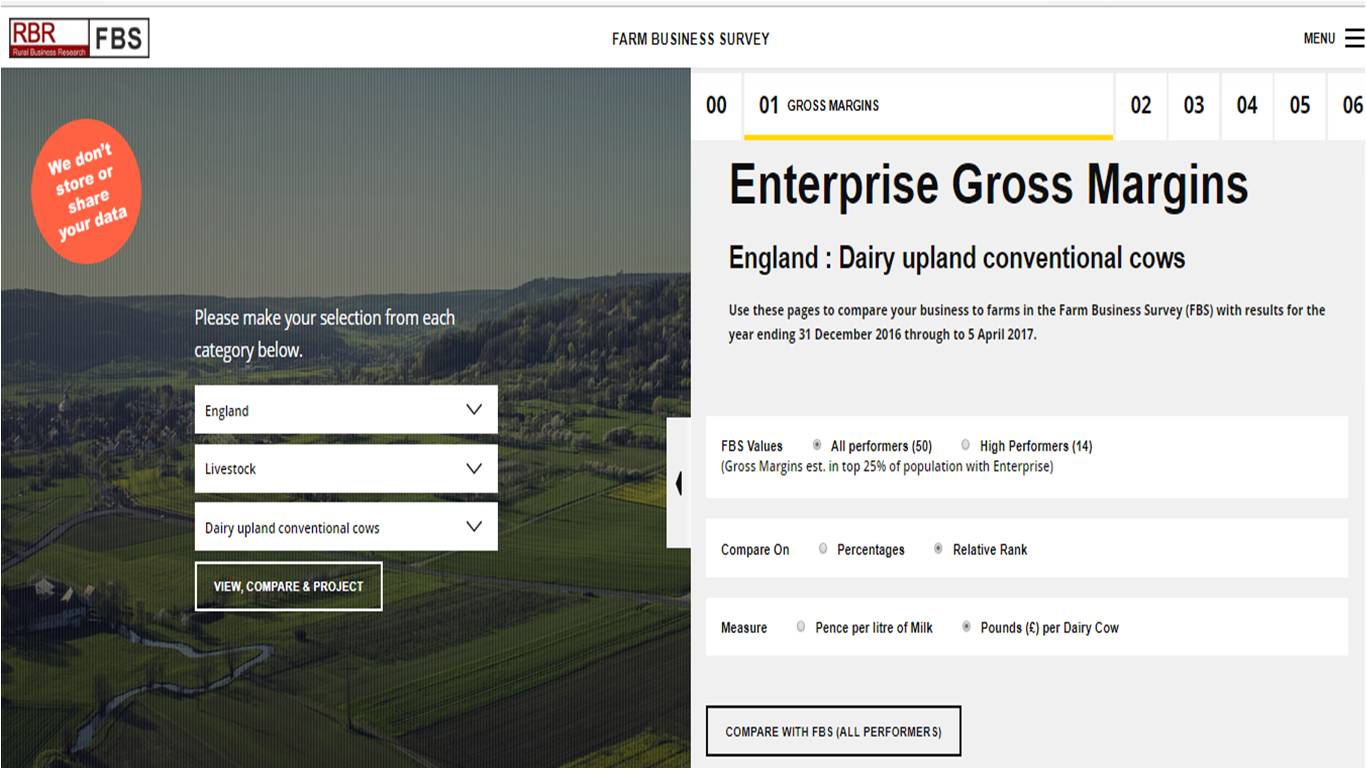

Check out these gross margin calculators with benchmark data (England/Wales) for livestock & crop farms…

To use the online comparison tool – click here…

Download these example gross margin calculations for farms in printable format…

Is your farm income divided among very distinct enterprises? Try a divisional income statement for each enterprise

Each divisional income statement should be dedicated to a single ring-fenced enterprise.

Although you might have many commercial divisions which sit under your roof, for granular control treat them separately.

As the trend is nowadays with with many farms, there are often a number of diverse income streams under the hood.

For a reliable reflection of whether individual enterprises are profitable in their own right, we need to ring-fence them as separate business units.

This way we get to assess their viability as standalone enterprises, which makes for much more decisive managerial or executive action.

N.B. […for the purpose of continuity and clarity, the mention of ‘farm’ in the context farm income, for example, or farm expenses is referring to your core farm enterprise – whether that be crops or livestock, typically.]

The Whole Farm Income Statement: Breakdown…

On our online travels we found 2 academic institutions with a well invested approach to teaching on the subject, we highlight them below:

- Alberta Agriculture and Forestry

- Iowa State University

Our effort at a breakdown…

The following breakdown is not a rule for how a farm income statement ought to be handled.

It’s more of a beginner’s guide to how we’ve noted leading reputed finance professionals and educational institutes would approach it.

The components of farm cash income – technically speaking

[A] Farm cash income – this is sales revenue collected within the stated time period, resulting from sale of (or otherwise, receipt of):

- crops,

- homegrown livestock,

- market bought livestock for resale,

- livestock products,

- government payments

- …and other miscellaneous income items.

Do include: cash earned from sales of breeding livestock before adjustments for capital gains, cash earned from crops on loan.

Don’t include: cash received from loans, or depreciable assets (such as land, buildings or machinery, for example)…remembering to to write separate income statements for each income source.

[B] Adjusted farm income – these are extraneous to the typical cash income items such as declared above, but for the sake of accounting treatment are counted as income. These include:

Do include: changes in inventory value & accounts receivable because this refers to income earned, but not received until the current time period.

Don’t include: changes in market value of depreciable assets, like buildings, vehicles and equipment.

The components of farm cash expenses – technically speaking

[C] Farm expenses – all cash expenses related to the budget

Do include: interest paid on farm loans, bank charges & wages to family members

Don’t include: death of livestock (this will be included within the inventory differential), income tax or social security payments (this is classed as a personal expense and should not therefore be included within a farm business income statement)

[D] Adjusted farm expenses – these are extraneous items to the run of the mill operational expenses, but technically treated as an adjustment to the final expenses figure

Conditions of adjusted farm expenses:

- Where expenses paid in one year are for items which are not actually used in operation until a following year

- …declare the proportional expenses due according to use of item in corresponding year

- Where expenses are incurred in one year, but not paid until a following year, like accounts payable

- …accounts payable, products or services purchased but not yet paid for – however…

- Don’t duplicate in expenses as well as applying in the adjustment – this is where your bookkeeping needs to be watertight as not to skew your end figures

- …accounts payable, products or services purchased but not yet paid for – however…

- Capital asset depreciation should be accounted for here as an adjustment to expenses

- (…‘depreciation’, being the amount in monetary value by which your capital assets such as buildings, land, machinery, equipment and vehicles, decline due to ‘wear & tear’ or obsolescence. Depreciation is calculated in varying ways for farm business accounting. Either way, we advise a realistic & consistent approach as not to use false measures.)

- Breeding livestock depreciation is also an adjustment of expenses

Summary figures within your farm income statement

Operational net farm income

This net figure comprises the total farm income minus the total farm expenses.

Capital gains and losses

Where capital assets like machinery, equipment, vehicles, land or building are sold within a trading period – the amount received in the transaction could be either more of less than the cost value, or basis, of the asset.

For assets which have declined in value (i.e. depreciable) the cost value, or expense recorded, is the original value, minus the depreciation (depreciated transaction price) taken.

Net farm income

Simply add either capital gain to or subtract capital loss from the operational net farm income.

This is your overall position, and your resulting measure of profitability for this particular business unit.

Adding revenue grants, subsidies, sundries and bank charges

The treatment of revenue grant income, subsidies, sundries & bank charges, as recommended by Dairy Co, is to include them within this income statement as follows:

- Farm income – revenue grants, subsidies, sundry income

- Expenses – bank charges

Sample Whole Farm Income Statement Excel Spreadsheets – Available To Download (Free)

There are two ready-made efforts available to download off the virtual shelf, produced by two reputable authors online.

Take a close look at the our digest below…

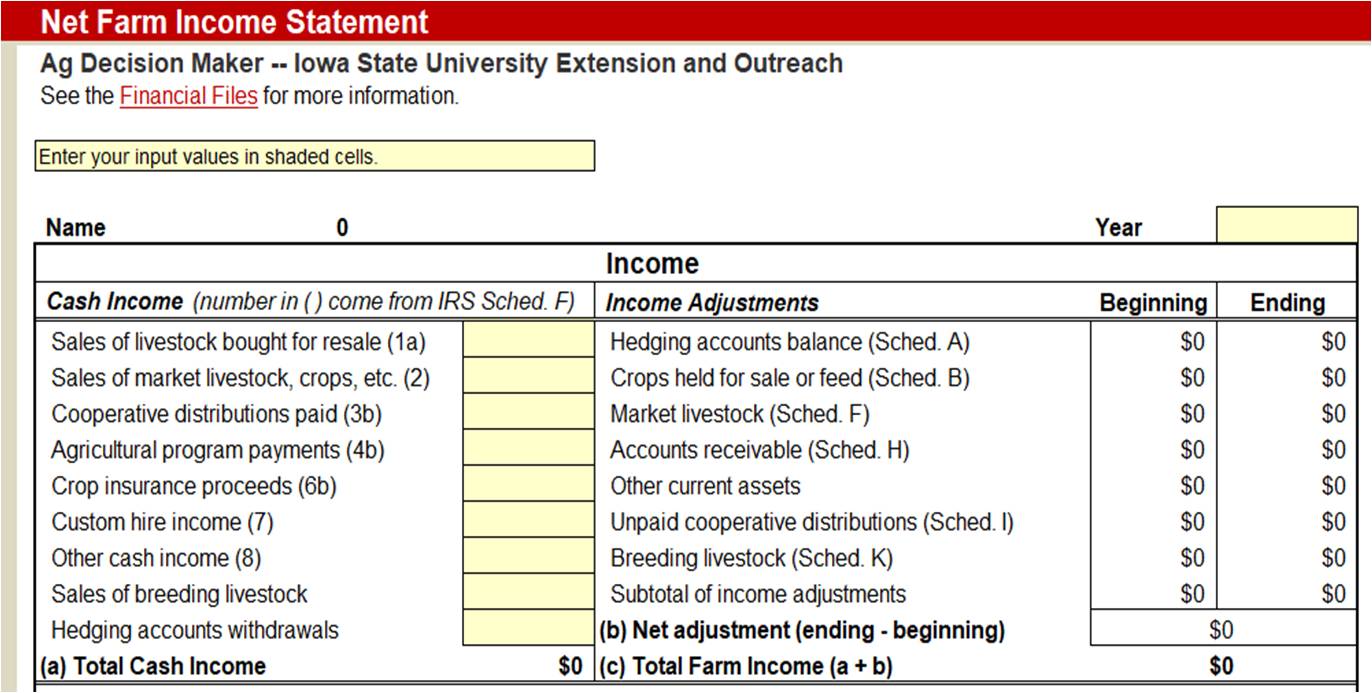

“Iowa State University wins the contest by a country mile!”

The author of the spreadsheet

Iowa State Uni serves in connecting the needs of Iowans with Iowa State University research and resources.

Their partnerships are designed to solve today’s problems and prepare for the future for the people of Iowa, including agricultural sustainability…hence this offering.

Intro

If you can look past superficial obstacles to relevance like the use of dollars, rather than pounds sterling; or Americanised terminology, like IRS (Inland Revenue Service…the tax man) then you’ll get great utility from this template.

Cash Income

A thorough breakdown of cash income is presented here, with bracketed references giving note to data entry tables embedded on another tab within the worksheet.

Income adjustments

A diligent line up of conditional amendments which might be applied according to standard accounting principles.

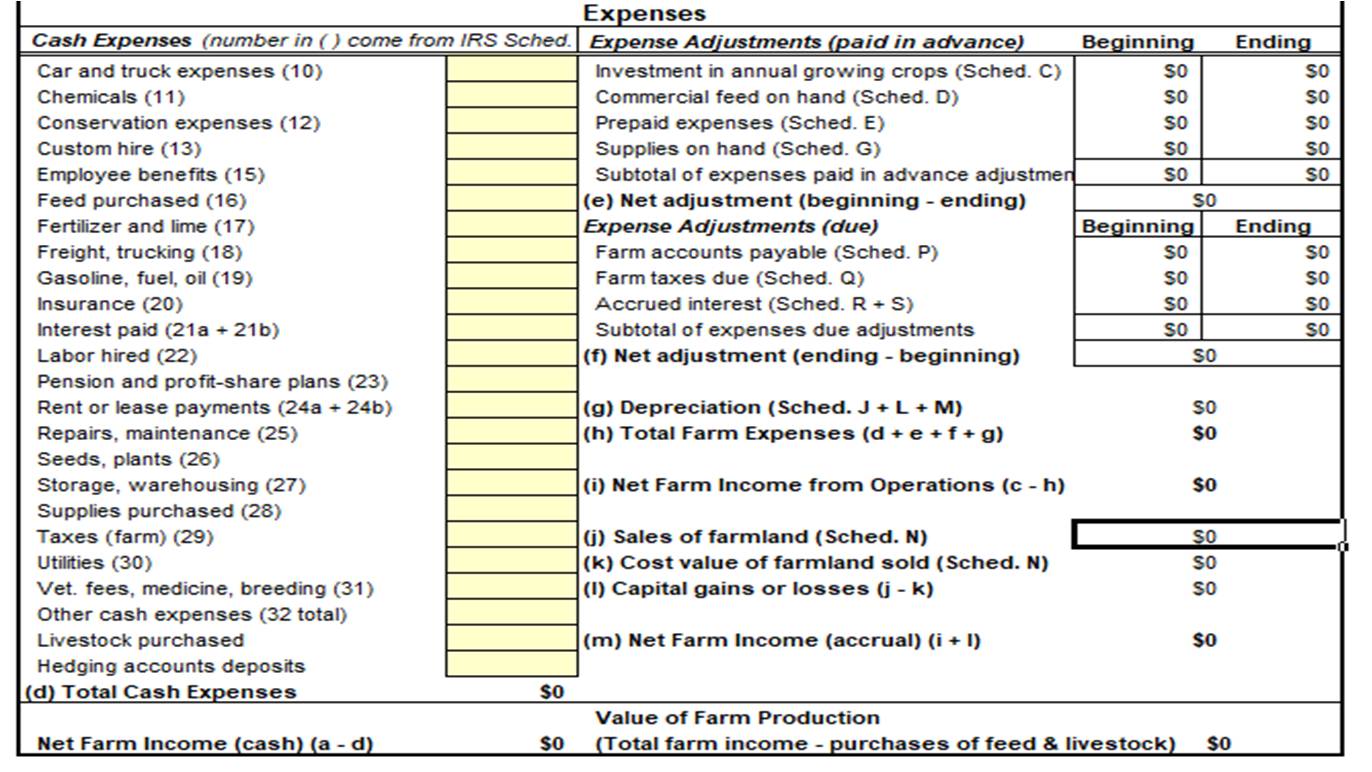

Cash Expenses

An itemised approach to cash expenses (both direct costs of sales and overheads thrown in together – a whole farm approach).

Expense Adjustments

A technically just treatment of expenses paid for and used across an annual period. Proportional allocation represented in ‘beginning’ and ‘ending’ figures.

Depreciation and capital gains/losses clearly denoted for completeness also.

Net Farm Income

A final figure on profitability on the whole farm.

…courtesy of Iowa State University

Our opinion?

“A solid academic effort. Highly detailed and itemised with user-friendly supporting notes for readers of all proficiency. A well rounded resource.” [SmallholdingsForSale.co.uk]

“Dairy Co gets the prize for a beginner friendly introduction…”

The author of the spreadsheet

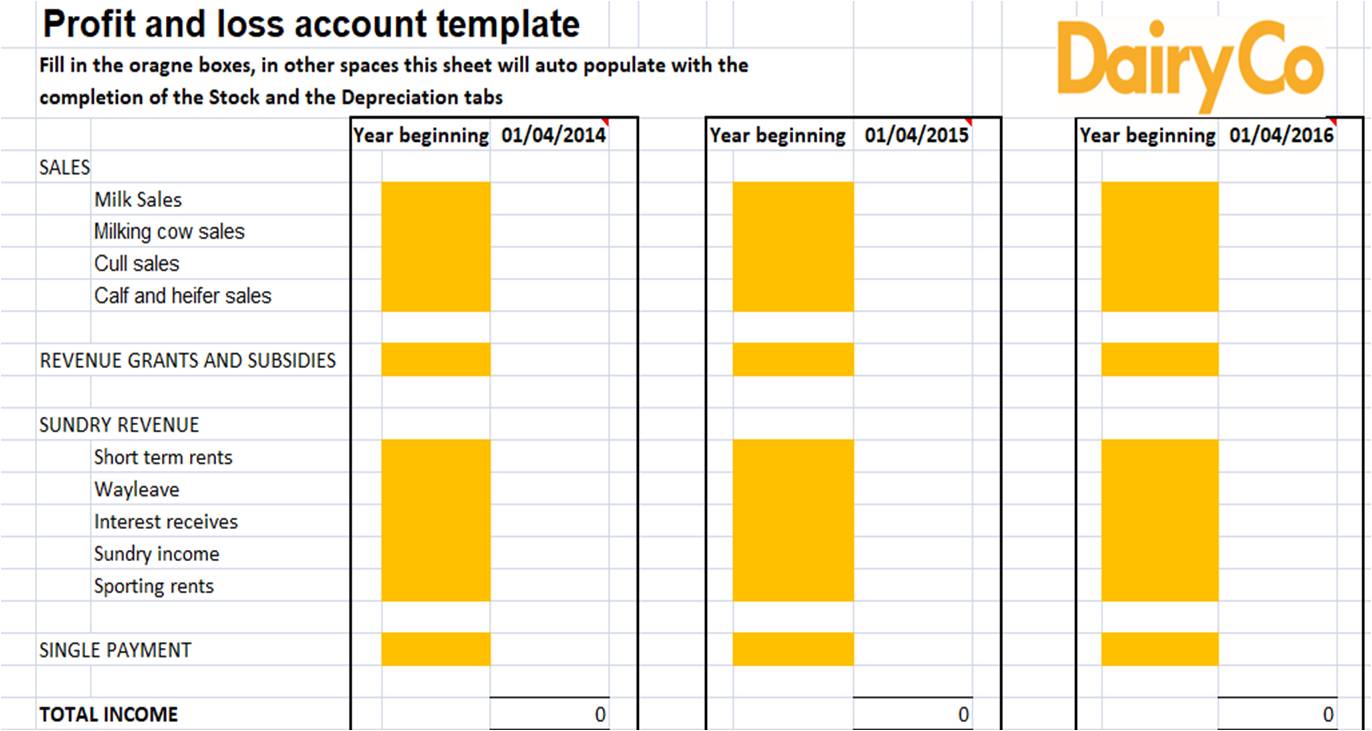

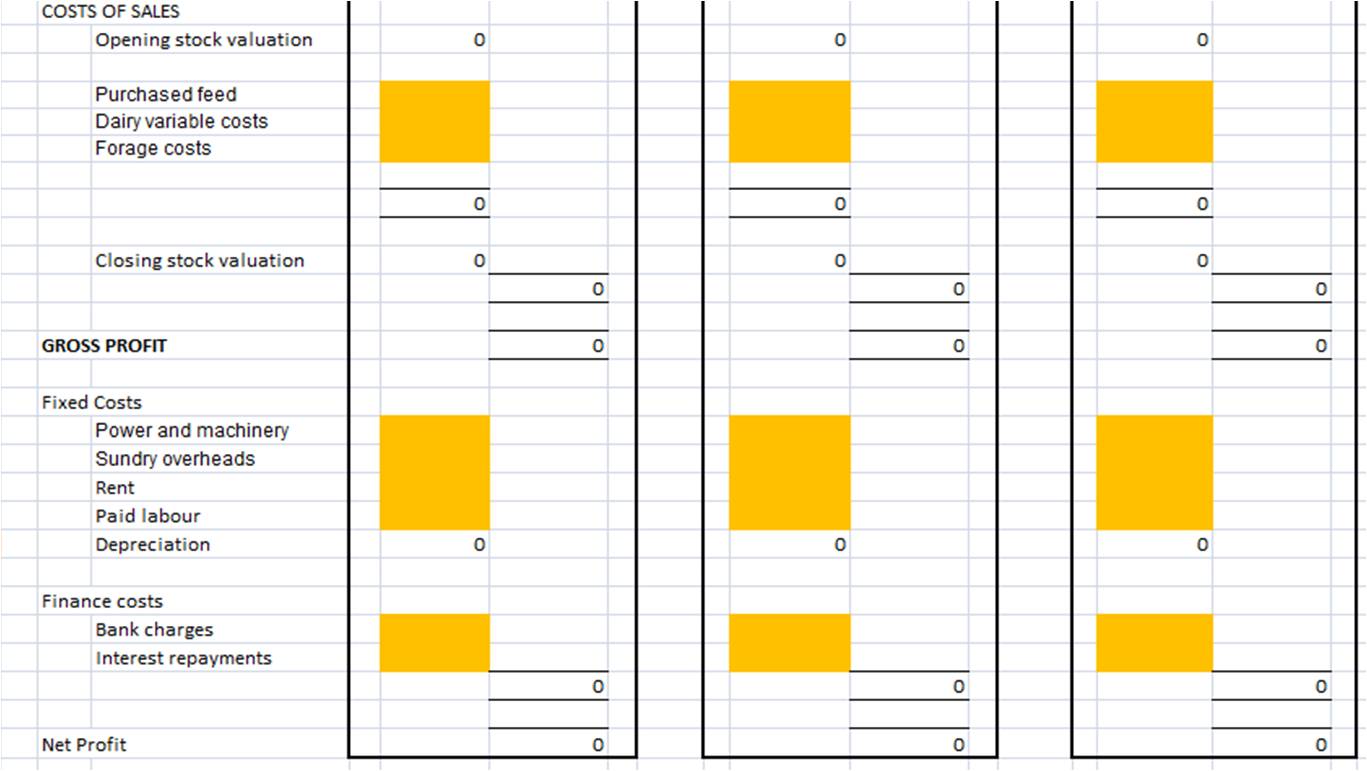

An example from Dairy Co – the not-for-profit organisation working on behalf of Britain’s dairy farmers

Intro

Their effort at building an Excel spreadsheet, dairy income statement for obvious reasons will be tailored to a typical dairy operation, but the principals will apply.

Income

The layout adopted here is to show a head to head comparison over 3 years of trade (their example below spans 2014, 2015 & 2016).

They group their income categories into:

- sales (direct dairy products sold),

- revenue grants and subsidies (other monies coming in from grants or support),

- sundry revenue (other income generated by other miscellaneous activities, like, fees received for allowing wayleave access to members of the public),

- and finally, EU the single payment scheme subsidy.

Expenses

Expenses are generally encompassed by the term ‘costs of sales’ aka ‘cost of goods sold (cogs)’ (which includes the direct cost related to rearing the cattle, i.e. forage or feed).

Gross Profit

This is the result of subtracting costs of sales from the Total Income figure in the image above.

Fixed Costs

After gross profit, the following items are pertaining to a net profitability figure for the whole farm. These fixed costs are common overheads incurred by running the farm as a whole.

Finance Costs

Charges incurred by using bank services are accounted for here, either as interest or fees.

Net Profit

This is the overall picture of profitability for your farm after all centralised expenses are taken account of alongside all income streams.

Our opinion?

“A simple method and one which will get beginners off the ground, but one which will leave questions asked by more financially proficient stakeholders & professionals.” [SmallholdingsForSale.co.uk]

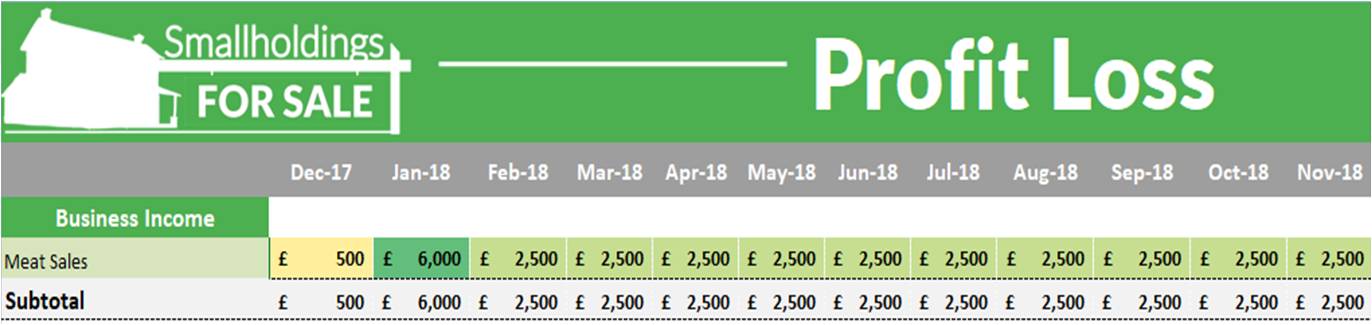

Too complicated for your small farm operation? Try this personal income spreadsheet.

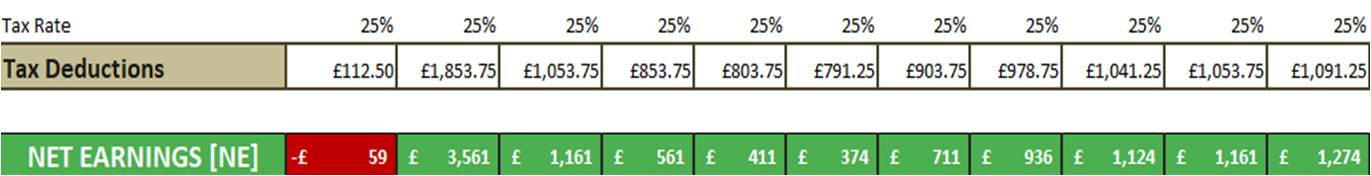

We have produced a premium formula personal income statement (.xls) (click here to download the spreadsheet) for small farm owners, which makes the most of smart conditional formatting to bring your finances up to scratch.

So, what makes these Excel (.xls) spreadsheets so special?…& worth the small investment…

This financial suite of spreadsheets has the following features:

- conditional formatting

- …colour coded cells for quick discernment of value ranges within templates

- …draws your eye to the most important details – quickly

- automatic populating

- …fully programmed equations for automatically populating already identified values

- …reduce duplication and error in calculation

- integrated statement components

- …extensive equation cross-references for integration

- …one part of the template talks to another relevant part – working together

- auto-calculating

- …smart programming of equations

- …save time on manually calculating – we done it all for you

- customisable

- …locked critical cells for maintaining integrity

- …change the details you want to make the plan fit your unique situation

Our version of a smallholder’s personal profit/loss in 14 steps:

1 – Net Farm Business Income

Your combined net figure for farm income will go here. You can get an accurate figure for this by using the instant PDF generator above.

The span of this spreadsheet planner is 12 months.

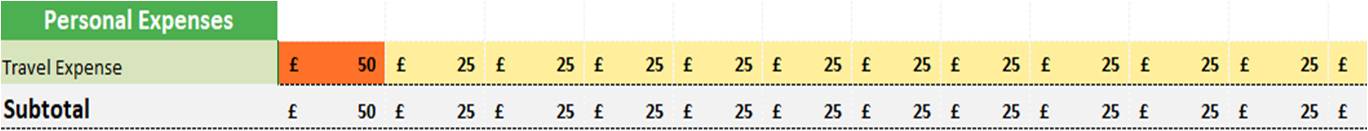

2 – Personal Expenses

This section deals with deductible variable expenses incurred in your smallholding running.

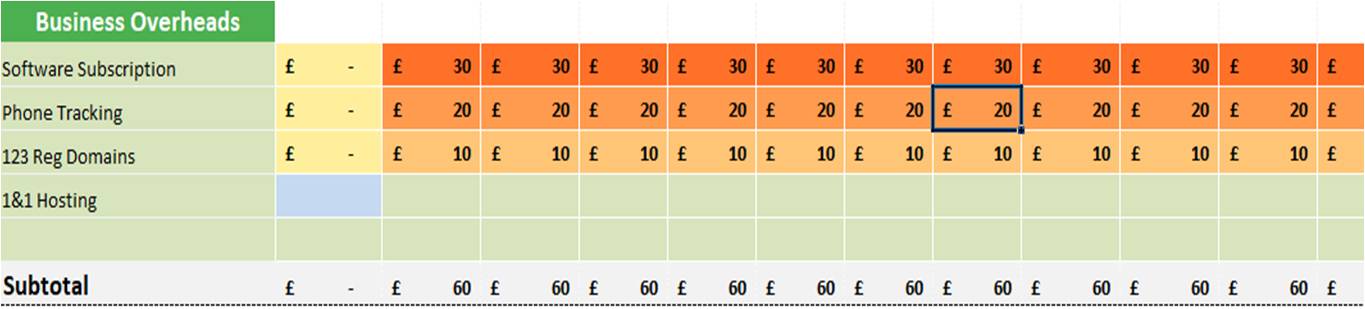

3 – Business Overheads

These are your fixed business overheads for your smallholding business.

4 – Personal Endeavour Profit

This is a simple enough figure which illustrates either the profit or loss of your business endeavour.

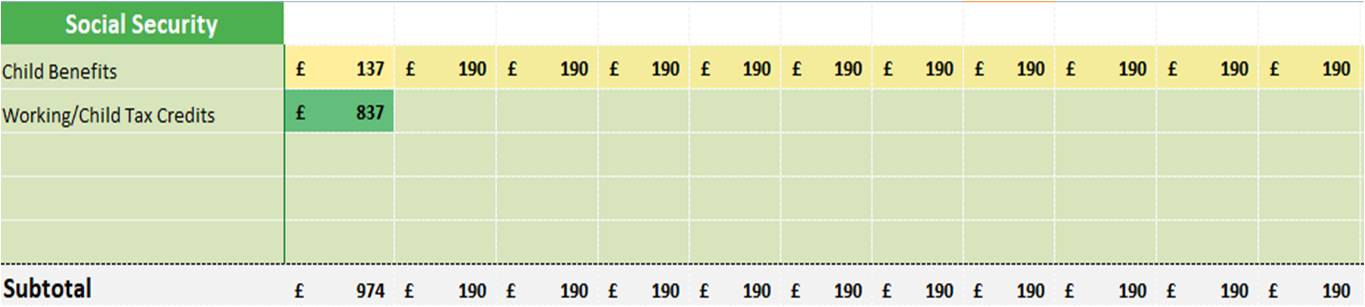

5 – Social Security Income

Do you have social security income, like working tax credits? Insert your figures here.

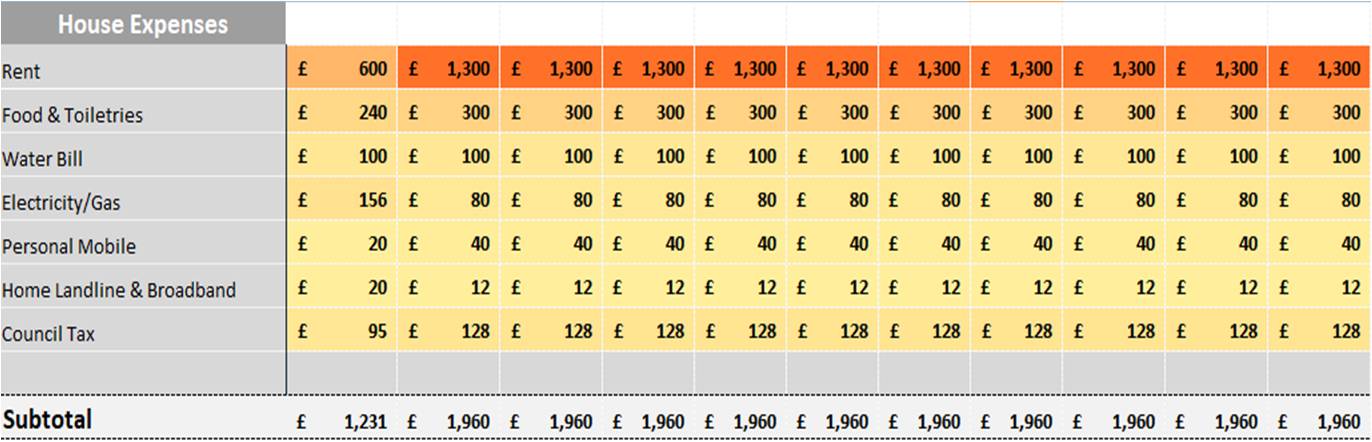

6 – Household Expenses

Slot in your household expenses here to incorporate your household expenses into your personal income statement.

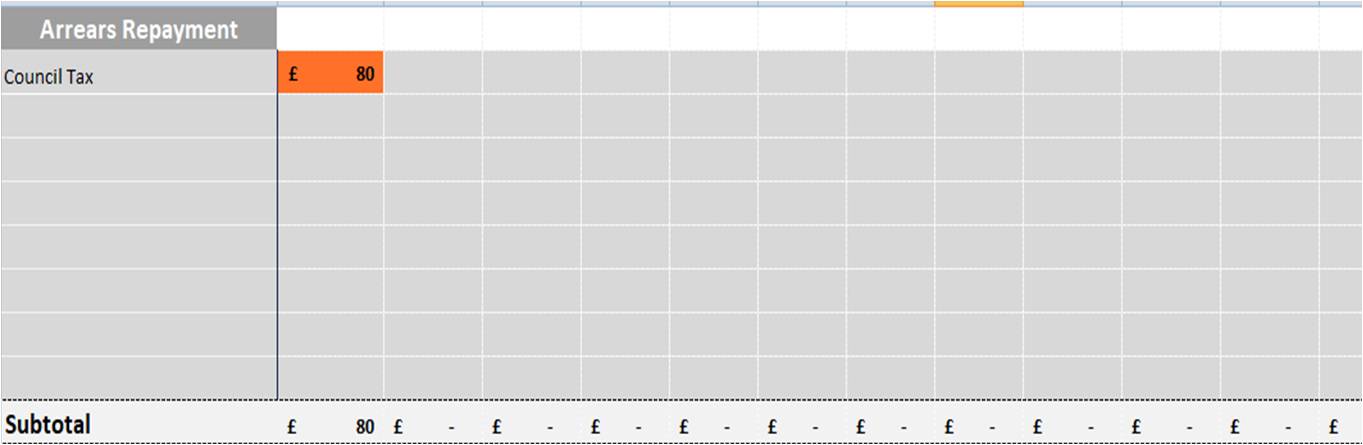

7 – Arrears

Owe arrears? Simply put in your numbers for each account which has back payments.

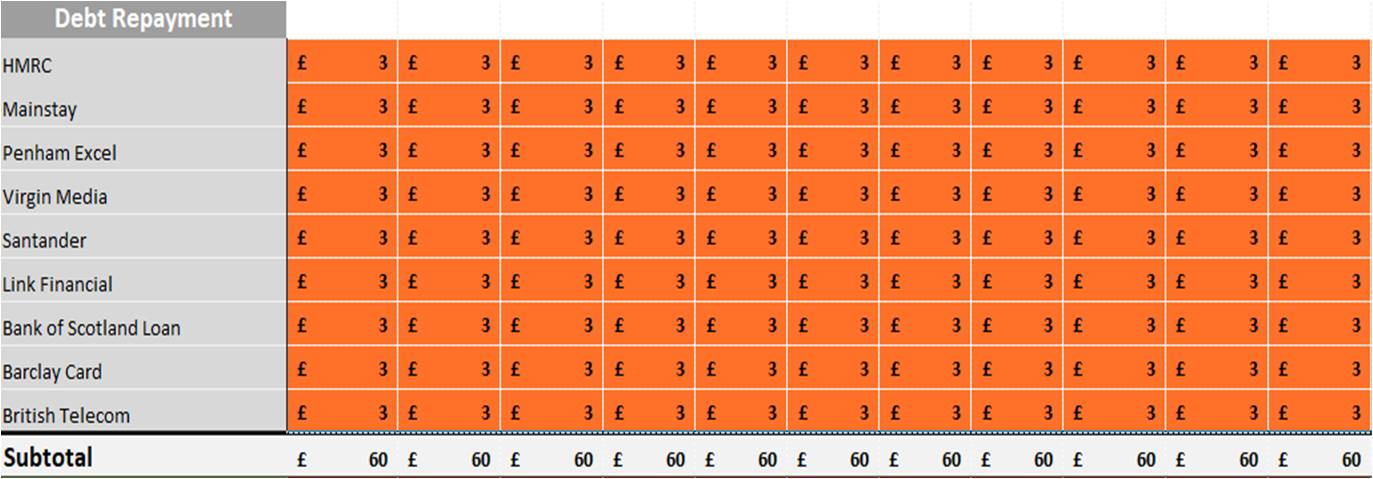

8 – Debt Repayment

Do you have debts outstanding with payment plans? This grid accounts for repaying debts.

9 – Fixed Personal Profit

This figure tells you the profit/loss position of your fixed income vs. fixed outgoings.

10 – Household Profit

Combining your fixed and variable income/outgoings in a neat figure gives you oversight of how profitable your household is.

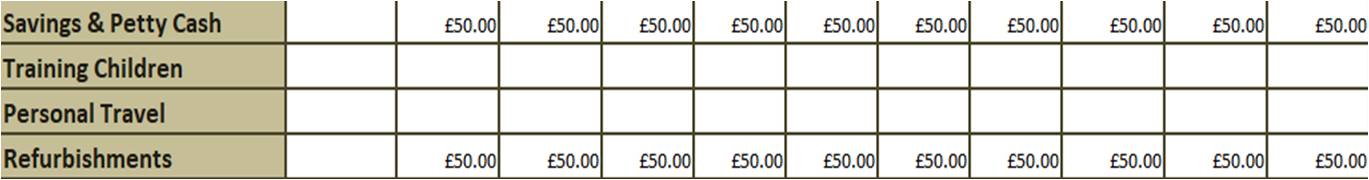

11 – Miscellaneous Expenses

Any extras? Put them in here to make sure a diligent job done on your final income position.

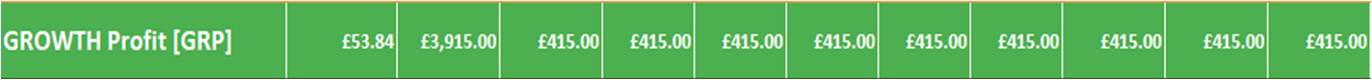

12 – Growth Profit

Want to know what is left over for reinvestment in your business or other ventures? Look no further, it is right here.

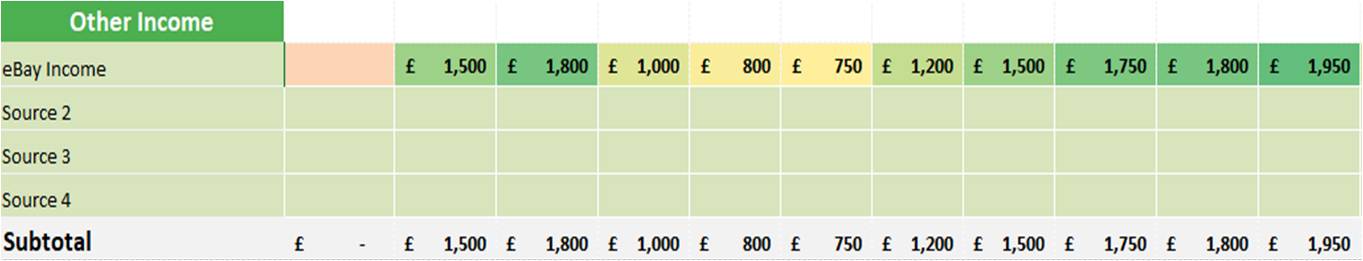

13 – Other Income

Earn any income from unrelated side ventures, like am eBay store, for example? Account for side income here.

14 – Taxes & Net Earnings

Et, voila! Your net income figure for your small farming household.