Every farm needs a cash cow to keep up the cash flow – glass half empty or half full, we walk you through the paperwork.

Your farm cash flow is either a projected estimation or historical snapshot of cash usage, revealing the pattern of its flow through your agri-enterprise.

The hypothetical projection is commonly called a Cash Flow Statement.

The historical statement is known as a Statement of Changes in Financial Position (SCFP).

As the financial position of your business continues to flux over the fiscal period, your cash flow statement gives you clear oversight of what’s actually available in your pocket.

What does a farm cash flow consist of?

The fiscal period the statement relates to us usually a year.

Accrual vs. Cash??

As small business owners and farmers know best – there’s a big difference between cash promised vs. cash in hand.

Accrual accounting speaks on behalf of cash due to be sent/received because of consumption somewhere.

Cash accounting speaks on behalf of cash received following a consumption.

Suffice to say, cash flow is to do with cash received or cash sent. Full stop.

[A] Cash coming in…

…typically from

- operating,

- trading assets,

- financing/investment

or other sources.

[B] Cash going out…

…from the same sections as named in the point above or indeed, inclusive of taxes.

Is that all there is to it?

Yes, and no.

As a recipe, it really is that simple in terms of ingredients.

Presentation, however, requires a little more consideration.

Importance Of Presenting Cash Flow Within Your Farm Business Plans…

So many business decisions are largely dictated by whether or not you have enough available cash in hand.

Cash flow statements demonstrate exactly that…cash in hand.

Therefore, informing ‘critical spend‘ decision-making would be the principal benefit of cash flow management.

Having the benefit of some foresight from projected forecasts, or strategic lessons learned from a historical cash flow analysis will help make better cash based decisions, ongoing.

What are the typical problems experienced by farms with managing cash flow?

In a word…shortage.

Much like plumbing & water for households, the purpose of cash flow analysis is to examine the supply vs. consumption needs of your farming business.

What happens when consumption of cash out strips supply?

Let’s put it this way…what happens when you need water and it’s simply not in the system?

Answer: You go without.

What are the consequences of poorly managed farm cash flow?

If unchecked, a spiral of continuing downward pressure, leading to the following:

- unpaid financial commitments

- arrears

- further debts

- loss of trade agreements

- higher costs (less favourable prices)

- serial account hopping

- increasingly shorter term credit hunting

- more disparate credit profile

- commercial short nearsightedness

- continual looking for new business

- anxiety

- fear

- hiding

- temptation for dishonesty

- threat of total financial decay

It doesn’t take much to find oneself in the situation above.

The knock on effect of cash shortage can suddenly creep upon a person, or a business.

Cash shortage leaves those under it feeling trapped and even surrendering to being defined by circumstance.

This can be a hard mindset to become free from once ingrained.

Cash flow forecasting and monitoring using smart business tools, like the ones below, helps prevent the rot.

How does your farm income portfolio measure up?

Cash requirement is continuous.

Think day to day of the kind of cash demands of your average household…food, toiletries, gas, electricity, petrol, insurance etc. or farm business…wages, animal feed, business rates, debt repayment etc…

…it never seems to end!

How well is your supply of cash flow positioned to meet the needs of your farm?

There are two important qualities of cash flow which define it’s suitability:

- Volume of cash available

- Timing of cash receipts

…in other words, was the cash received enough to meet current needs?

And, is expected cash due to come in likely to arrive in time to satisfy your farm’s consumption needs?

In order to confidently answer, “Yes” to both questions above, prudence would have farm businesses diversify income.

Mix-up your income profile with a proportional weighting of both short term vs. long term income potential.

Endeavours which afford a more balanced profile of receipts offer greater cash flow resilience.

Where too much dependence rests upon one stream of income or another, your farm holds greater financial risk.

Less emphasis should be placed on the amount of cash per transaction, but more frequency and volume of transaction.

Struggling with cash availability? Discover your farm’s cash flow problem profile.

When your farm business struggles with cash flow, dig deep for an accurate diagnosis.

As with all things, honesty is the best only policy.

And denial deceives.

The root question to answer is…”why does your farm suffer cash flow problems?”

The answer will generally fit one of the following categories:

‘Conditional’ A: “Things aren’t usually this rough…it’s just a bit of temporary turbulence.”

‘Definitive’ B: “I’ve never really hand a firm handle on cash…this is just typical. Something better change!”

Again, we emphasise…honesty is the only policy.

If the answer to the question above is conditional, then you’ll want to produce a remedial course of topical corrections.

However, if poor cash flow is just definitive of how your farm business has been running to date, then a far more invasive/root-level upheaval could be in order.

The Whole Farm Cash Flow Statement: Breakdown…

Leading the charge in our online research findings on the subject of cash flow for farms and agricultural businesses are the following institutions:

- Iowa State University

- Alberta Agriculture & Forestry

- Irish Agriculture & Food Development Authority

Our effort at a breakdown…

The following breakdown is not a rule for how a cash flow analysis ought to be handled.

It’s more of a beginner’s guide to how we’ve noted leading reputed finance professionals and educational institutes would approach it.

The components of farm cash flow – technically speaking

[A] Operating Cash – this details the cash transactions into and out of your farm business directly due to operational effort:

- crops,

- homegrown livestock,

- market bought livestock for resale,

- livestock products…etc.

An equation for calculating operating cash:

- Accrued Net Income (from your income statement)…

- plus, Depreciation Expenses…

- minus, Increase In Current Asset Value…

- plus, Decrease In Current Asset Value…

- plus, Increase In Current Liabilities…

- minus, Decrease In Current Liabilities…

…equals…Net Cash Flow From Operating Activities.

[B] Investment Cash – these are cash transactions which arise from either buying or selling items used for investment in your farm business, like:

- machinery,

- equipment,

- land,

- buildings,

- loans made to others,

- shares purchased in companies

[C] Financing Cash – all cash transactions between the business and it’s owners or creditors i.e. those who have assumed the personal position of bearing the load of the business’s cash requirement in exchange for the prospect of a direct financial return, or portion of ownership.

Include:

- new loans,

- proceeds from issuing shares,

- repayments,

- dividends

[D] Personal Cash – this covers any form of cash transaction between you, as the owner of your farm business, and your farm itself on a personal basis.

Monies in are called contributions.

Monies out are called withdrawals.

Simple.

[E] Taxes & Accounts – income tax or accounts receivable or payable are accounted for here. Net accounts receivable or payable is produced as a combination of the starting and ending figures either side of the period in question.

Summary figures within your farm cash flow analysis

Net cash

This is total cash inflows minus total cash outflows

Start balance

The amount of cash your farm business possesses at the start of the period.

Operating loan (received/repaid)

Separated out from other loan engagements is this operating loan section.

The rationale for special treatment is on the basis that the cash involved in this arrangement is integrally involved in the day-to-day cash requirements of the business.

Having it separated out helps visibility and monitoring.

Interest on operating loan

Pitched directly against the particulars of the operating loan, these interest repayments add a net perspective to the operating loan obligation.

End cash balance

Overall net cash position of your farm business within the related period.

The Dangers Of Cash Flow Drought To Your Farm Business

The dangers of teetering on the edge of cash flow (in)stability are manifold.

The threats are very real.

Much in business is related to reputation and ability to uphold relationships & obligations.

Each business-to-business interaction depends to some degree upon trust.

On one side, knowing you’ll receive products or services as agreed…

…whilst on the other side, believing you’ll receive due payment for goods or services tendered.

Good will is no guarantee, but in some ways it is better.

It underpins the giving of mercy although undeserved, could make all the difference if given when needed – we’ve all been there.

When the cash flow jitters hit, such feelings lead to all kinds of irrational and nearsighted thought processes.

Such a mindset is very much focused on immediate relief, even at the expense of long term disadvantage and/or desolation.

Some typical areas of danger related to farming cash flow practicalities are:

- mistiming seasonal fluctuation – having all your income arrive (…& just enough) during fruitful months, leaving no cash available during fruitless months…a crash/boom cycle

- pressure to sell assets (income generating items) – in order to fill the immediate gap today, many will be willing to sell substantial prospect of earnings tomorrow…weakening the future position

- financing becomes more tempting – as options to stay afloat narrow down, borrowing short term cash at high interest rates becomes somehow more ‘attractive’…digging a deeper hole

- lengthening repayment duration of loans – wanting to hold on to cash in as many ways as possible becomes the desire, namely delaying repayment of existing debt…available credit becomes the estimation of wealth

- refinancing – packaging debt and selling it on to secondary/tertiary financiers who at sign-up have more permissive terms, but operate far more aggressively in collection to off-set their riskier profile…debt upon debt

- increasing non-farm income – looking for other means of getting money in becomes a high priority as confidence in bread & butter enterprise crashes…don’t be deceived, all start-up needs investment & nurture

Beware Of Debt

Debt kills business.

It’s a false measure.

However, in a financial age where debt is valued commercially, debt has become desirable.

It enables businesses and people to reach for those things are not theirs to have.

Once received, the result is a continual dependence upon an artificial stimulant, just to survive.

Credit (the gateway to debt) gives the false impression of available cash availability.

It alters the reality of the recipient and produces a false sense of security.

Whilst the debtor has the short term benefit of cash for today, their consumption of credit is the eating of the fruits of tomorrow’s labour.

Debt brings deficit.

The only escape is to turn out of the illusion and turn into the suffering of reality…

…hoping for becoming loosed from the deficit through the incremental and gradual organic profits of hard labour.

What if your current farm enterprise is in need of a new idea or two?

Diversification is a popular route out of cash instability for farmers.

However, the most popularised solution for insufficient cash of a capital loan for start-up is not always necessary.

In fact, why take out debt on a new venture when it’s success is yet to happen?

And should it happen – it will need plenty nurturing to fully embed…so prudence advises against borrowing to start something new.

If you need a capital lump sum that you don’t have to start a new venture – this tells you, that venture just isn’t for you.

There are so many alternative business ideas, many of which don’t require much to begin, or are in fact zero-start-up.

Diligent research (online & offline) will lead you to endless affordable opportunities for diversifying income – without the need for credit (debt).

Sample Farm Cash Flow Excel Spreadsheets – Available To Download (Free)

Want a go at writing your own farm cash flow analysis?

These following institutions have done all the hard work of formatting and engineering templates to use straight off-the-shelf – best of all for free!

Without further ado…

“Iowa State sets gold standard for cash flow.”

The author of the spreadsheet

Iowa State Uni serves in connecting the needs of Iowans with Iowa State University research and resources.

Their partnerships are designed to solve today’s problems and prepare for the future for the people of Iowa, including agricultural sustainability…hence this offering.

Intro

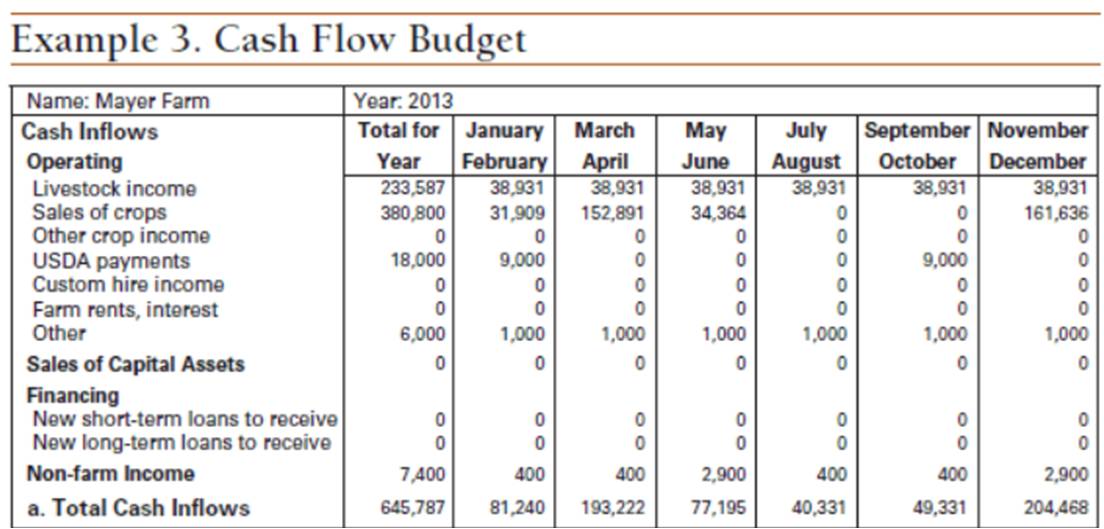

Set over a 12-month period this cash flow budget sets a forward looking projection toward expected cash flows in months to come, set against last year’s total.

Actual vs. projected.

Operating cash inflows

This is an itemised list of operating cash income from your core farm business efforts.

Sales of capital assets

This is income derived from the sale of capital items owned by your farm business within the period.

Financing

Money inflow from credit gained from investors or owners is allocated here.

Non-farm income

Income gained from other enterprises aside from core farming is input here.

Total cash inflows

Simply, a total of all contributing cash inflows.

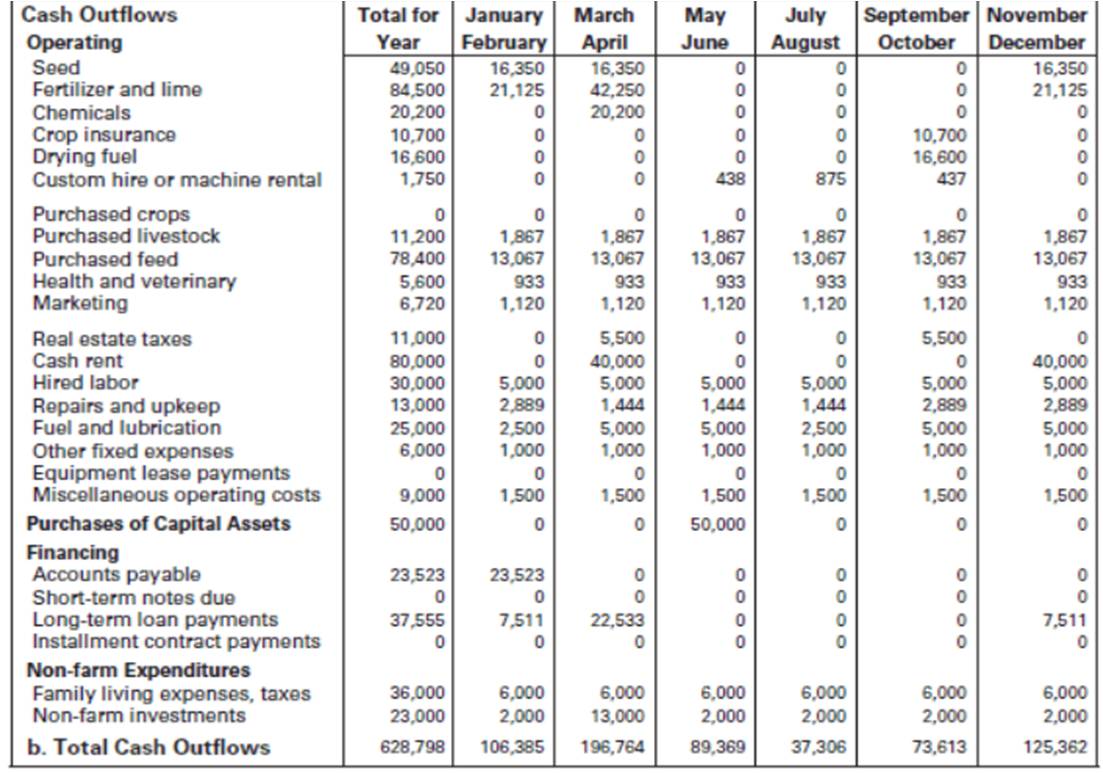

Operating outflows

Direct cost of goods sold plus business overheads combined within this accounting period.

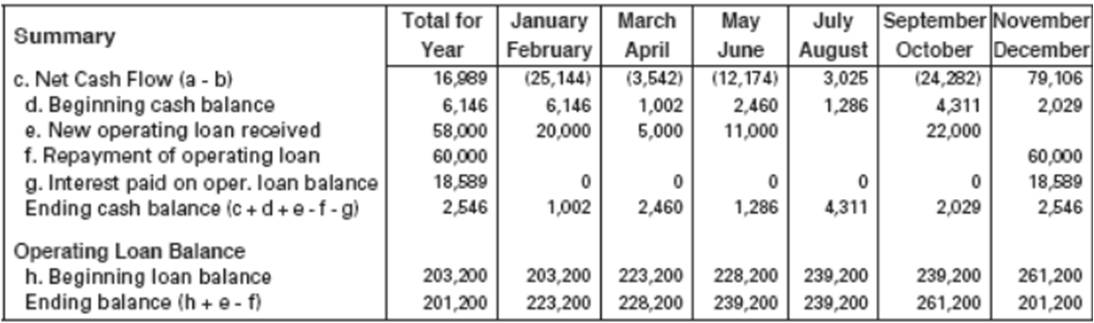

Net cash flow

Total cash inflows minus total cash outflows.

Beginning cash balance

Cash on balance at the beginning of the period.

New operating loan received

Money entered into the operating budget due to a loan specifically for operational use goes here.

Repayment of operating loan

Paying back the operational loan goes here.

Interest paid on the operational loan

Diligently separating out interest from the capital loan sum gives visibility when reviewing the repayment scheduling.

Ending cash balance

Cash remaining in the business budget after all activity is deal with.

Beginning (operating) loan balance

Ring fenced view of the remaining sum left to pay on that operating loan arrangement

Ending (operating loan) balance

How much is left to pay on that operating loan? Here it is.

…courtesy of Iowa State University

Our opinion?

“A leading example of how smallholdings and small farm owners ought to separate out their pounds and pence on an ongoing basis. Technically sound and a standard to aim for.” [SmallholdingsForSale.co.uk]

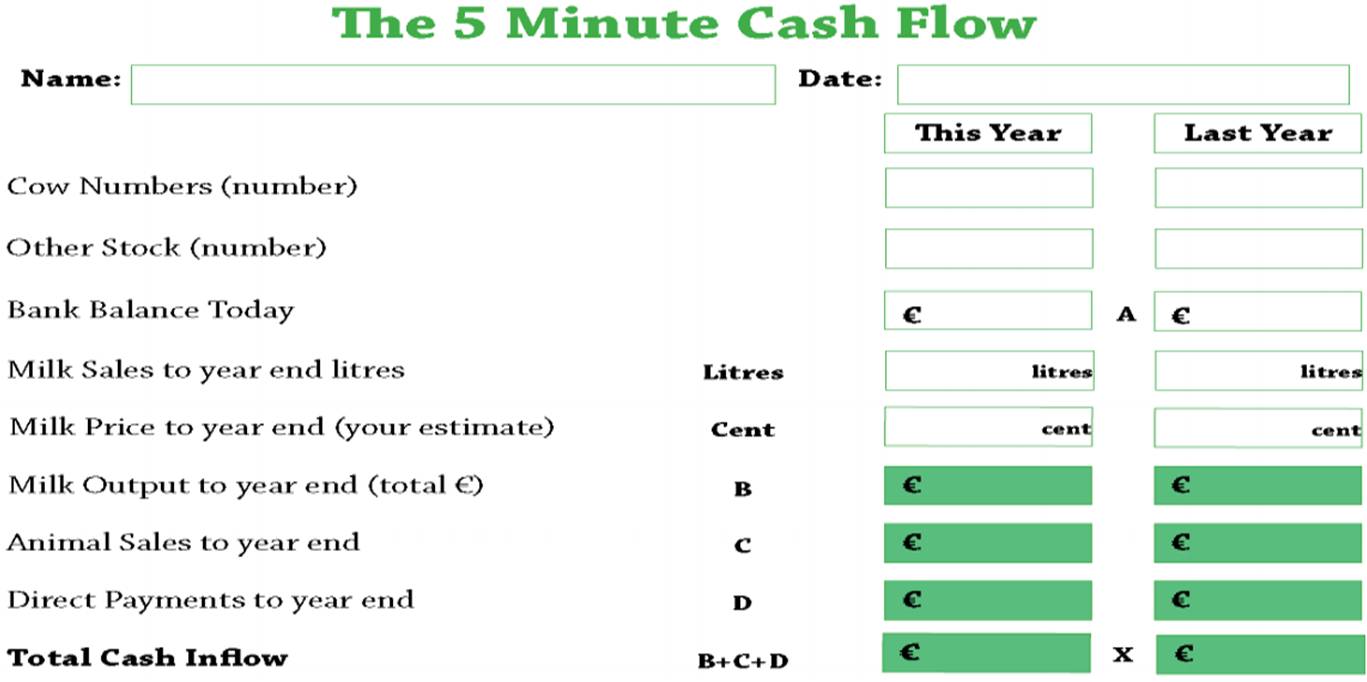

“Got 5 mins? Teagasc will get your cash flow up to scratch.”

The author of the spreadsheet

A semi-governmental research and development agency in Ireland for providing advisory and training to the agricultural sector and rural communities.

Intro

A great introduction for beginners into the mysterious realm of business cash flow. Based largely on a dairy farming operation – but allows enough room for manoeuvre.

Cow numbers

A simple tally or head count of your cows.

Other stock

Any other livestock? Place the numbers in here.

Balance today

How much money does your farm business have on balance at the time of asking? Place it here.

Milk sales to year end (litres)

A physical sum of milk output for the time period in question.

Milk price to year end (your estimate)

The price you achieve for selling milk produced by your farm.

Milk output to year end (total in currency)

Total monies made from milk sales by year end, either projected or actual of last year.

Animal sales to year end

Money received from selling livestock.

Direct payments to year end

To be honest, we’re not quite sure what this section alludes to – any thoughts? Comment below.

Once off investments to year endAny unique investments made out of your farm’s cash funds within the year.

Tax bill to be paid

Tax which is due that year, accrued from earnings made that year.

Contractor

Contractors may be called in to your farm to perform operational tasks separate to cost of goods sold, but rather an overhead. Payments against the cost of contract is declared here.

Feed costs to year end

The cost of providing feed for the herds is kept here.

Vet and other costs to year end

Costs of veterinary services and other livestock care would be entered here.

Loan repayments to year end

Monies paid for sums owing would be entered.

Family living costs to year end

Expenses paid out of the farm budget on living costs for the family are accounted for here.

Total cash outflows

A sum of all outflows above.

Net cash flows

Total inflows minus total outflows of cash.

Predicted bank balance

The amount of money left in the bank after all transactions for that period are accounted for and starting balances applied. In short, an ending cash balance.

…courtesy of TeagascOur opinion?

“A dairy slant – but easily transferable to any agricultural business set-up. Largely made easy by the digestible presentation and style of communication used. Good work.” [SmallholdingsForSale.co.uk]

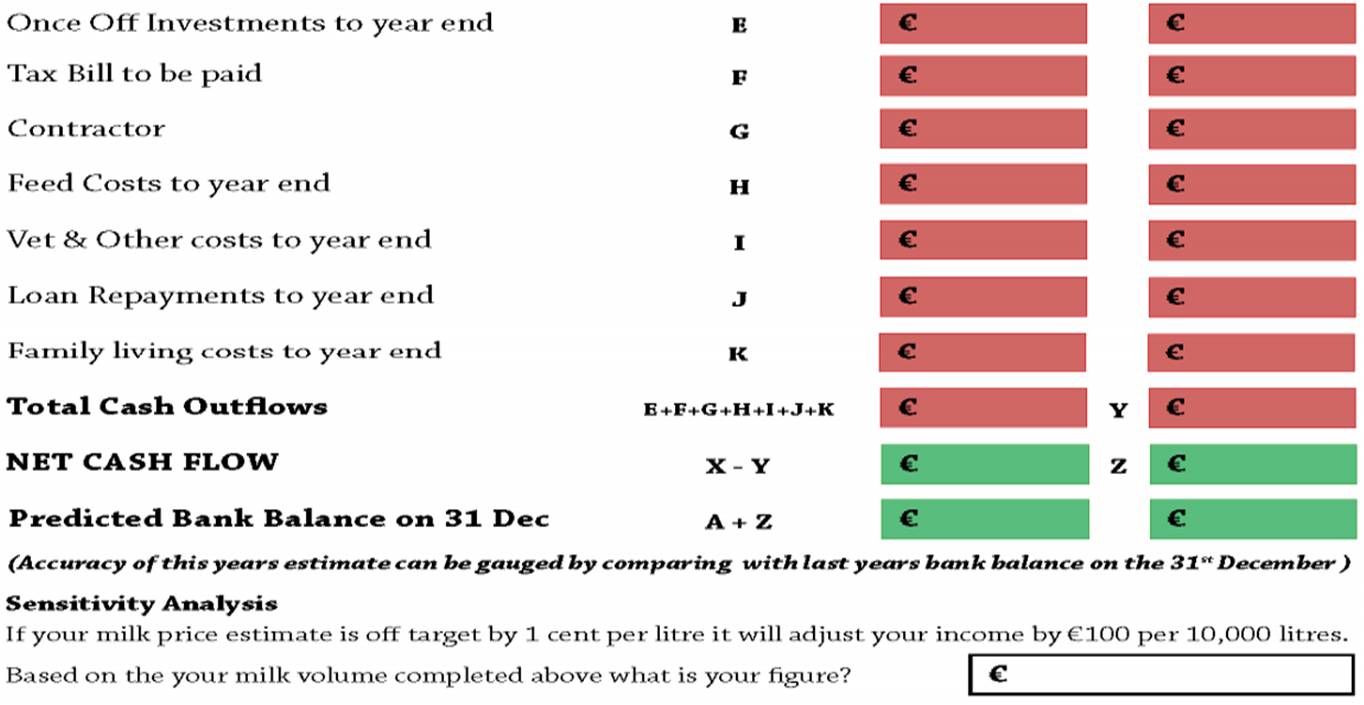

Are you confusing your personal and business cash flow? Establish better budgetary control with this Excel template

We have produced a premium formula personal cash flow statement (.xls) for small farm owners, which makes the most of smart conditional formatting to bring your finances up to scratch.

So, what makes these Excel (.xls) spreadsheets so special?…& worth the small investment…

This financial suite of spreadsheets has the following features:

- conditional formatting

- …colour coded cells for quick discernment of value ranges within templates

- …draws your eye to the most important details – quickly

- automatic populating

- …fully programmed equations for automatically populating already identified values

- …reduce duplication and error in calculation

- integrated statement components

- …extensive equation cross-references for integration

- …one part of the template talks to another relevant part – working together

- auto-calculating

- …smart programming of equations

- …save time on manually calculating – we done it all for you

- customisable

- …locked critical cells for maintaining integrity

- …change the details you want to make the plan fit your unique situation

Our version of a smallholder’s personal cash flow in 4 steps:

1 – Cash Balance (Start/End/Net)

Your main business cash account is tracked within this section.

The grey band, ‘Summary‘ shows a breakdown of months, which behaves as a header table row within this template.

Beneath the grey band is a light green band represents figures related to available balance at the start of the month.

The row beneath which starts with a green cell called, ‘Net Cash Balance‘.

The figures following this green cell in series are corresponding net cash balances for each month.

Net cash balances are calculated by subtracting the ‘Balance Avail. Start of Month‘ away from ‘Cash Balance End of Month‘.

Below this row, the head row cell has the following text, ‘Cash Balance End of Month‘.

It shows the net cash amount after both the starting balance and ending balances have been taken into account.

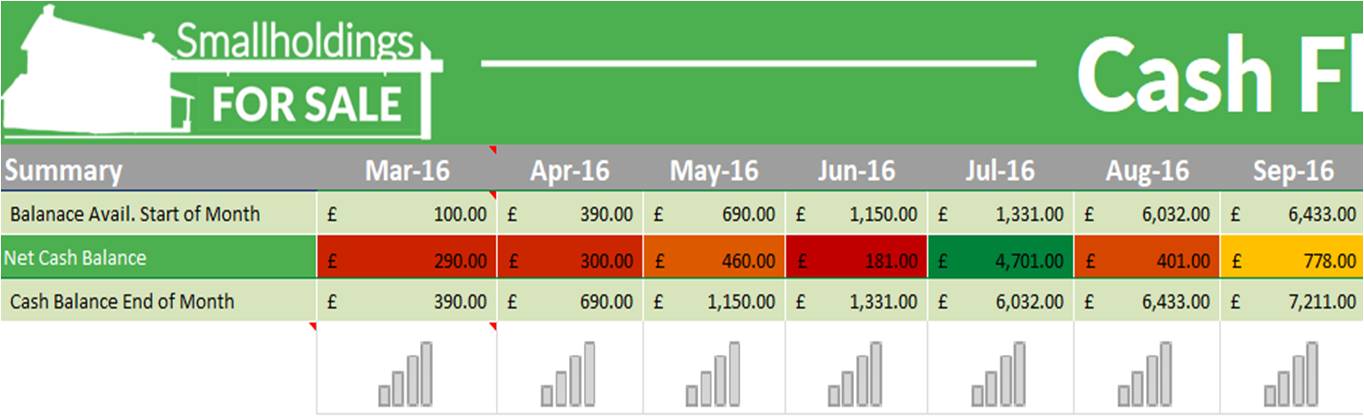

The graphical bar chart illustration below this row gives a single glance view of relative monthly net cash balances throughout the year.

2 – Monthly Net Cash Balance Bar Chart

This is a single bar chart representing the monthly net cash balance of your main farm business bank account across the period under examination.

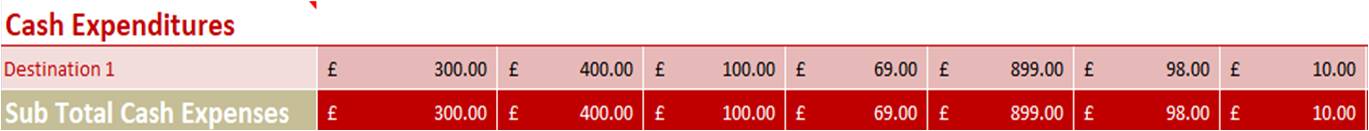

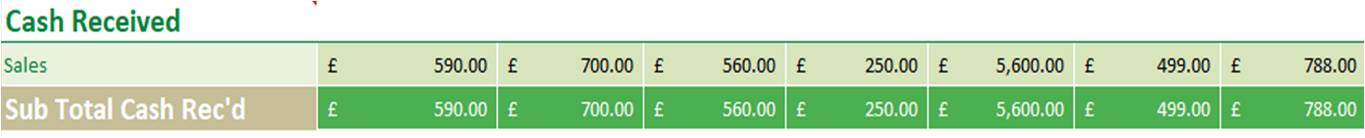

3 – Cash Received

This is your cash received each month into the main farm banking account.

4 – Cash Expenses

This is a grid of cash expenses related to your farm business.